While looking at the performance over the previous 12 months (or any time period for that matter), we need to be cognizant of the base that we are working from.

You might have heard investor gurus talk about “Coming off a low base” or “Coming off a high base”, but what does that actually mean?

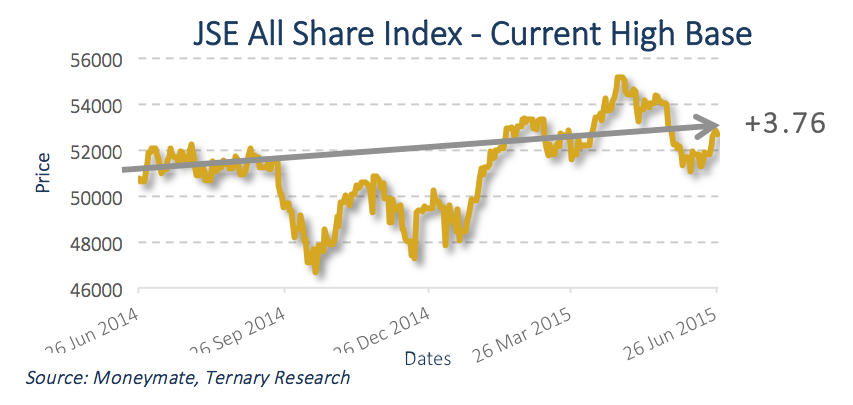

To illustrate what they mean by “the base”, let’s have a look at an example in the form the JSE All Share index over the last 12 months, which grew by 3.76%:

This low 12 month growth figure could be seen as a results of the high base it is coming from, just before the dip during the latter part of last year.

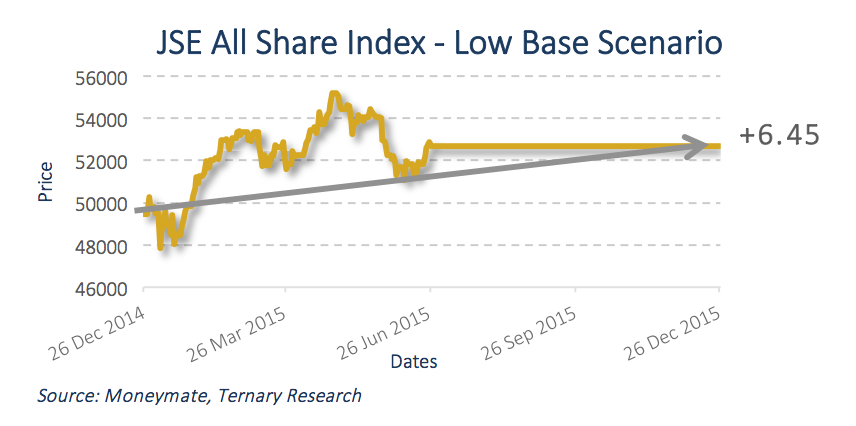

If the JSE stabilized where it currently is for the next 6 months, we will see a significant increase in the 12 month performance figures even though there is no immediate movement at all. This will be due to a low base as illustrated below:

Given the examples above, we urge you to always take note of the time-frame of the reported investment performance figures as it is very easy to choose a time period to suit any argument. Always ensure that you compare apples with apples!

If you would like us to help you compare your apples, please do not hesitate to get in touch.