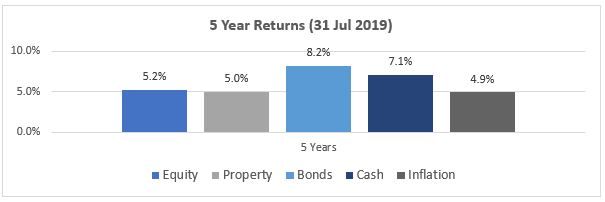

Both the South African equity and property market has had quite a poor showing over the last five years. Meanwhile the more defensive assets such as bonds and cash have done really well over the same period.

There are many reasons for these poor returns (not discussed here) which you may have read about on various news publications; State Capture, Poor Economic Growth, Trade Wars, Brexit etc. These have all played a part in the low returns we have experienced.

This has led to many investors questioning the value of assets such as equities and who are now considering (if they have not already done so) selling out and investing in more cash like instruments such as money market accounts and fixed deposits with banks. These assets are certainly providing attractive returns right now and it does make sense to invest in these if you have short term goals such as a car or house deposit.

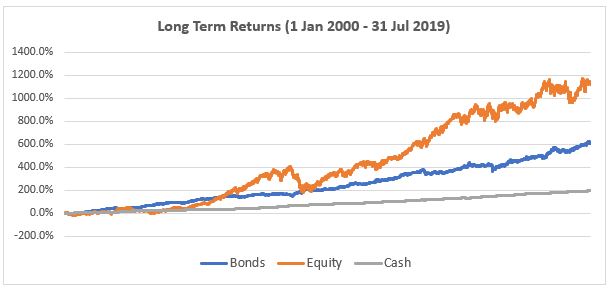

If you are however investing for the long term such as your retirement or drawing an income from your retirement savings, it certainly does not make much sense to sell out due to this underperformance. History has shown us that over the very long term, growth assets such as equities will outperform. Short term losses will also be made up over time if you stay invested.

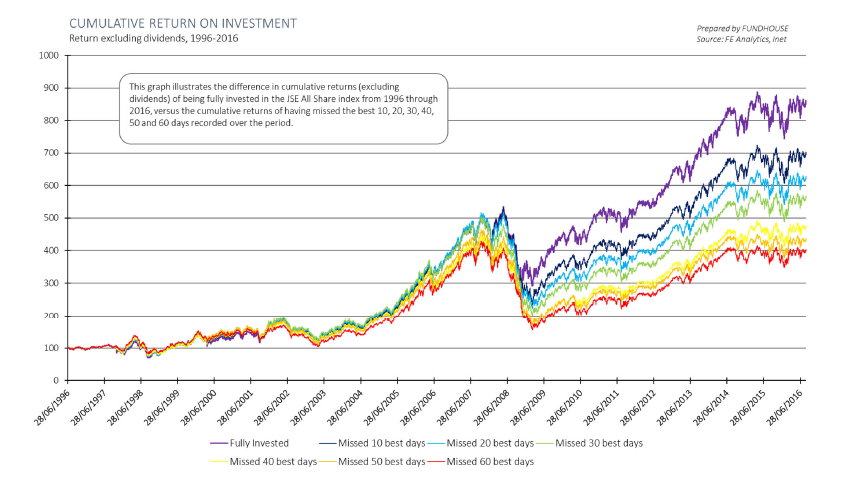

“So, what if I sell out now and go back in when the markets do pick up?” Well good luck with that. As advisors we strongly discourage this type of behaviour. Trying to “time” the market is a sure way to destroy long term potential growth. By just missing the “best” days of the equity market, you would have greatly reduced your long term returns.

The above shows by just “missing” the 10 best returning days of the JSE over the last 20 years, your returns would have been almost 20% less than having just stayed invested and gets worse the longer you are out the market. This is why we encourage you to stay invested and ride out these low return periods. Patience is a key factor in investment success.

The above shows by just “missing” the 10 best returning days of the JSE over the last 20 years, your returns would have been almost 20% less than having just stayed invested and gets worse the longer you are out the market. This is why we encourage you to stay invested and ride out these low return periods. Patience is a key factor in investment success.

Regards

Team Ternary