When investing, an important question you should be asking yourself is “How long do I need to invest for” or “When will I need my money back”. If we were to completely disregard your emotional tolerance to risk and assume everyone is risk-neutral, then your investment horizon alone can determine what type of investment is best suited to meet your goals.

For example, you just recently became a mother/father and would like to start a college fund for your child or you have finally decided to make the big step up and move out of your parent’s basement and get your own place. Both these examples have very different “investment horizons”. In the case of the college fund, you will most likely need the money after 18-20 years, whereas deciding to get your own place, you will probably need money for a deposit in the next 3-5 years.

To achieve these goals, you will need to give these investments the best opportunity to work for you and maximise your potential returns. A very long term investment, like the college fund, would enable a high weighting towards growth assets. These would be your equity and property investments. If your investment horizon is a bit shorter, like the house or flat deposit, a combination of growth and defensive assets would be more suitable. Defensive assets would be your fixed interest and cash investments.

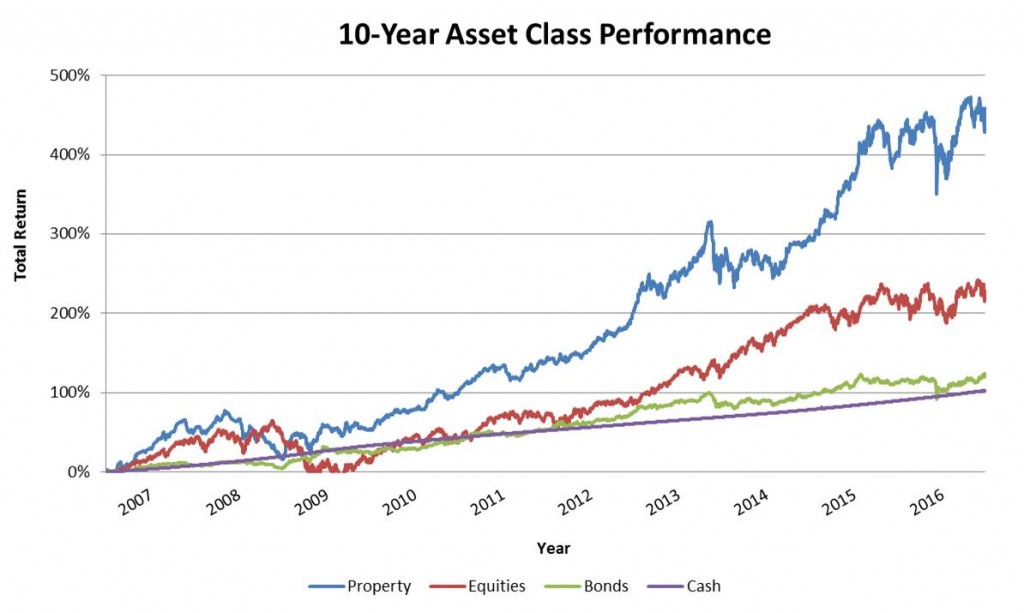

The below graph gives an idea of how well these assets (based on the major South African Indices) have performed over the last ten years (up to 30 June 2016).

Source: MoneyMate

It is quite evident to see that the growth assets (equites and property) provided investors with the strongest returns over the past 10 years. The defensive assets (bonds and cash), did not provide as strong returns, however they are shown to be much less volatile.

This is where choosing the right assets based on your investment horizon becomes crucial. Over the long term to give yourself the strongest potential returns, growth assets is your best bet. This is due to these assets only flexing their muscles and showing whose boss over long term investment horizons. However over the short term, these assets exhibit high levels of volatility and the potential loss of capital is much higher compared to the defensive assets. This is why when you have a short investment horizon, protecting your capital can be much more important and defensive assets become a much more appropriate investment.

In the end, choosing which investment is right for your goals can be a lot more complicated than just deciding on which asset class to invest in based on your investment horizon. A lot of other factors can come into play when making these decisions and this is something we can assist you with, so feel free to get in touch.