We often hear the saying “buy low, sell high” when it comes to investing. The principal is simple, buy assets when they are cheap and sell when it becomes expensive and this will result in amazing profits. Unfortunately, the ordinary man or woman on the street does not know when assets are cheap or expensive. Not to mention, buying low and selling high is just a more sophisticated way of saying “market timing”, which is something we strongly discourage.

We as financial advisers however encourage a long-term approach to investing and always remind our clients that investment markets move in cycles. This means that there can be periods of strong performance and there can also be periods of poor performance. It is one of the harsh realities of investing.

So how do we combat this? The answer is simple, stick to your goals and ignore the noise. Think of the “buy low, sell high” idea but without the “sell high” part. For many of us retirement is still a very long way away and we can use these market cycles to our advantage. While it is not ideal, down markets do present opportunities especially if you are saving money on a monthly basis. The reason being you are constantly buying cheaper assets with a fixed amount of money. This results in you effectively buying more of those assets on average each month.

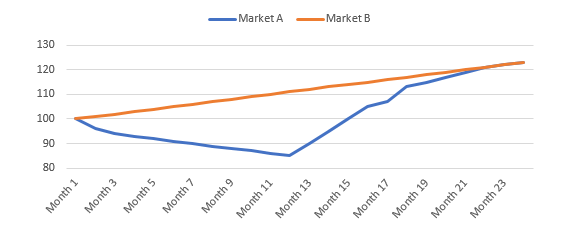

Let’s consider two hypothetical examples; the market is going down for a sustained period of time before it abruptly spikes up in value (Market A) compared to a market that is constantly going up (Market B). In both cases the ending value is the same.

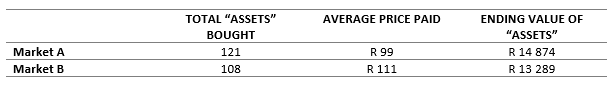

On first glance, Market B seems to be the best option, little volatility and without any sleepless nights. Market A started poorly and may have had many investors worried, however pulled back at the end. Even though both markets ended at the same price, if you stuck to your goals and continued to invest on monthly basis, Market A comes out on top. This is due to the “buy low” principal as mentioned earlier. For example, investing R 500 monthly into Market A and Market B would have resulted in the following:

The above shows that while poor market performance can be disheartening and cause panic, it does have its clear advantages if you are willing to stick to your financial goals and take a long term approach to investing.

The above shows that while poor market performance can be disheartening and cause panic, it does have its clear advantages if you are willing to stick to your financial goals and take a long term approach to investing.