One often hears that financial planning is crucial for your financial freedom, but what is it all about? You might have found yourself asking someone:

- How and where do I invest?

- How much should I be saving?

- How much life, disability or dread disease cover is needed?

- How much income do I need for retirement?

- How much should I invest locally or offshore?

Unfortunately, there is no straight answer to any of these questions. All these questions (and more) can be answered with a financial plan, crafted and discussed with a financial planner. As each of us are different, we have different incomes, spending styles, life stages, financial goals and circumstances – no one financial plan will be the same. It is all context dependent.

A good financial plan is the foundation of your financial freedom. This is not a “one-size-fit-all” solution, but tailored to fit your needs, goals and objectives. A financial plan should be a living plan, able to change and adapt as your life circumstances change. As we all know, “life” can happen in the blink of an eye.

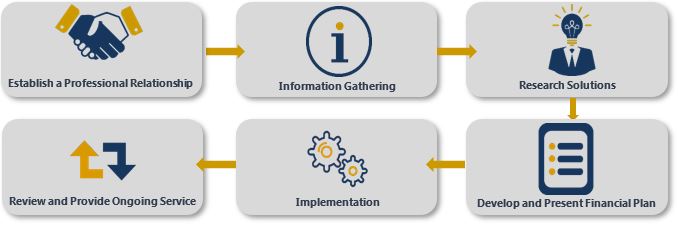

Generally, there are six steps which are followed in the financial planning process between a planner and a client. These are:

Step 1: Explaining the services to be provided to you and defining the relationship, as well outlining the responsibility of both parties. The planner should clearly indicate how they will be remunerated for their services.

Step 2: It is crucial for the client to disclose as much information as possible to the planner as this will form the foundation of the advice given. You and your planner should define your personal and financial goals, understand the time frame for results and discuss your appetite towards risk.

Step 3: Next, the planner analyses the information to assess your current situation and determine what you should do to meet your goals and objectives. This can include a full financial analysis of all your assets, liabilities and cash flow, current insurance coverage, investments or tax strategies – or be limited to specific advice which you have asked for.

Step 4: Next, the planner should offer recommendations that address your goals and objectives and go through these with you. It is vital that you understand the crux of the advice given, for you to make an informed decision. The planner then has an opportunity to listen to your concerns and revise the recommendations as appropriate.

Step 5: Both the client and the planner should agree on how the recommendations will be carried out and implemented. The planner and their team should act as financial coaches in this regard and co-ordinate the entire process with you.

Step 6: Your plan should be reviewed regularly (or when “life happens”) to ensure that you are on track to achieve your financial goals and objectives – to guide any changes that you might need to make.

What does your plan look like, and will it be able to guide you when “life happens”?

We’d love to hear from you – contact us today!