The Minister of Finance, Tito Mboweni, delivered the national budget speech on 24 February 2021. The budget speech brought some tax relief for individual taxpayers as well as companies.

Aspects which will have an impact on individuals are:

-

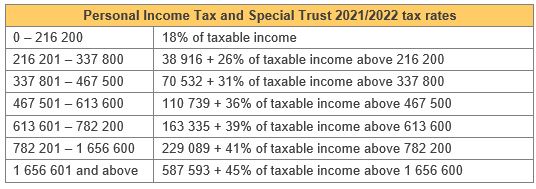

Income Tax: Individuals and Trusts

The personal income tax brackets and tax for special trusts were increased above inflation by 5%.

The tax rate for Trusts [other than special trusts] remain unchanged at 45%.

-

Corporate Tax

The corporate income tax rate will be lowered from 28% to 27%. The new tax rate will be applicable to companies with a year of assessment commencing on or after 1 April 2022.

-

Individual Rebates

Individual tax rebates have been increased with approximately 5% across all age thresholds.

-

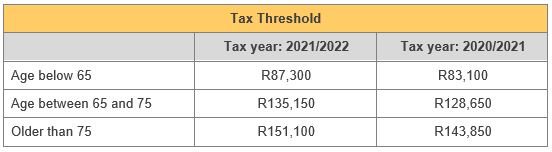

Tax Thresholds

Individuals earning an income below the tax threshold are not subject to pay income tax. Tax thresholds were increased by approximately 5% per age category.

-

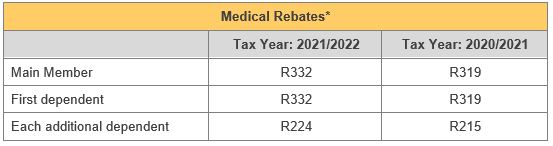

Medical Rebates

*Please contact your tax practitioner for more information on the additional medical expenses that can be included under this section.

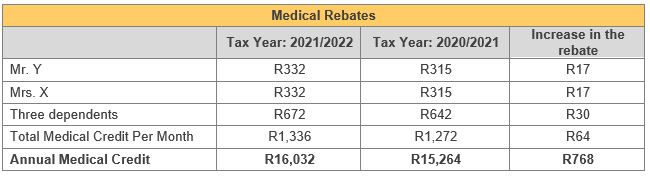

We explain the medical rebates by way of an example below:

Mr Y is the main member of his medical aid. He has three children and is married to Mrs X.

Mr Y’s Medical tax rebate is R16,032 during the 2021/2022 tax year, compared to R15,264 during the 2020/2021 tax year. This means that Mr Y will pay R768 less income tax during the upcoming 2021/2022 year of assessment.

-

Paid Up Retirement Annuities

Individuals below the age of 55, and a South African tax resident, who wishes to withdraw their retirement savings previously were allowed if the value was less that R7,000. The threshold was increased during the National budget speech from R7,000 to R15,000. The amendment is effective from 1 March 2021.

-

Other

Regulation 28 of the Pension Funds Act – Emphasis on Infrastructure

One of the proposed changes mentioned in the budget speech was to amend Regulation 28 of the Pension Funds Act, to make it easier for retirement funds to invest in infrastructure. Part of the change is to define infrastructure as an asset class. This will introduce a more precise definition of infrastructure and allow government to more accurately measure and collect data.

Increase in Sin Taxes

The Minister announced an increase of 8% in excise duties on alcohol and tobacco products.

Petrol, Diesel and Road Accident Fund

An inflation linked increase of 15 cents per liter for petrol and diesel, and 11 cents per liter increase in the Road Accident Fund levy will be implemented on 7 April 2021.