Real Estate Investment Trusts, commonly referred to as REIT’s, are listed companies that trade on an exchange (such as the Johannesburg Securities Exchange). These companies however only invest in income-producing real estate. This can be office parks, shopping malls and hotels or storage centres, apartment buildings and industrial facilities (there are many more).

REIT’s are similar to unit trusts, in that they give investors easy access to invest in large scale property, which would normally have very high barriers to entry. However, unlike unit trusts, REIT’s can be traded in real time like any other share on an exchange.

REIT’s should not be confused with property unit trusts. REIT’s are actual listed companies which own and operate various real estate, whereas a property fund is a type of unit trust, which focuses primarily on investing in REIT’s and occasionally direct property investments.

Some of the benefits of investing in REIT’s include:

- Diversification – REIT’s provide strong diversification benefits when investing in multiple asset classes. Many multi-asset fund managers invest some portion of their assets in REIT’s.

- Liquidity – as mentioned above, REIT’s can be traded on an exchange. Therefore, when these securities become unattractive they can easily be sold off.

- Dividends – Similar to listed shares which pay out dividends, REIT’s also pay out dividends to investors. However, unlike listed companies which can pay dividends at their own discretion, REIT’s are obligated by law to pay out most of their profits to investors.

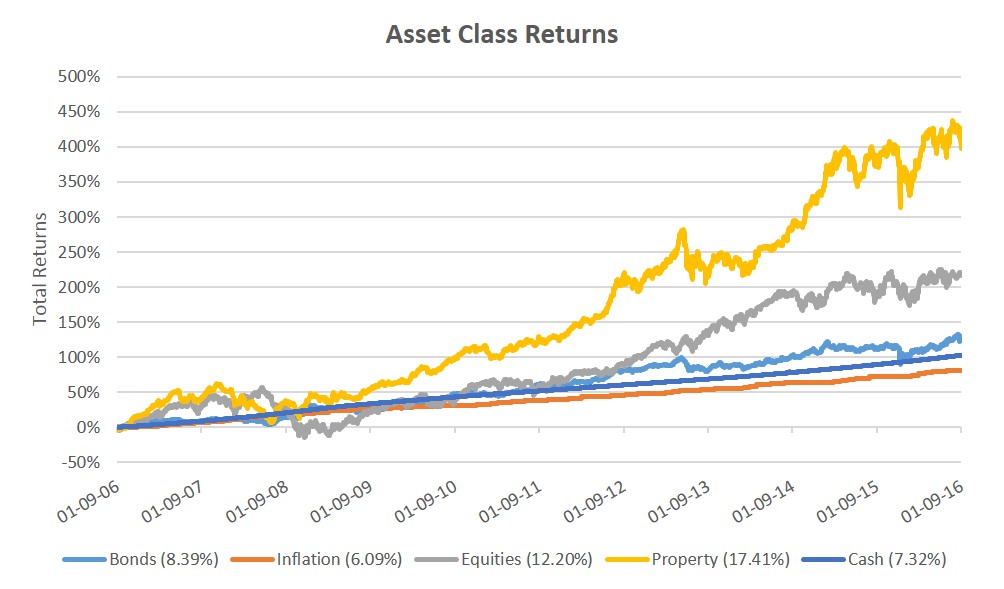

In South Africa listed property has been the top performing asset class over the last ten years (as at 01 September 2016) outperforming equities by over 5% (on an annualised basis). The below graph gives indication of how property has performed against the other major asset classes in South Africa (including inflation):

However, similar to other investments, REIT’s are not without their risks. One of the major risks is rising interest rates, which can reduce demand and consequently the value of REIT’s.

Therefore, when deciding which investments are best for you, it is always most beneficial to diversify between multiple asset classes to reduce your risk. If you are uncertain of how property should form part of your total portfolio, we will gladly assist.