This year’s Budget Speech was probably one of the most anticipated by all South Africans, but surprisingly Minister Gordhan and his cabinet did not pull (some expected) rabbits out of the hat.

The speech delivered addressed a year one budget in a three-year budget cycle. Whether you think the speech was back-to-basics or not bold enough, this is what the tax changes mean for you:

- Personal Income Tax , Value Added Tax and Interest Exemptions

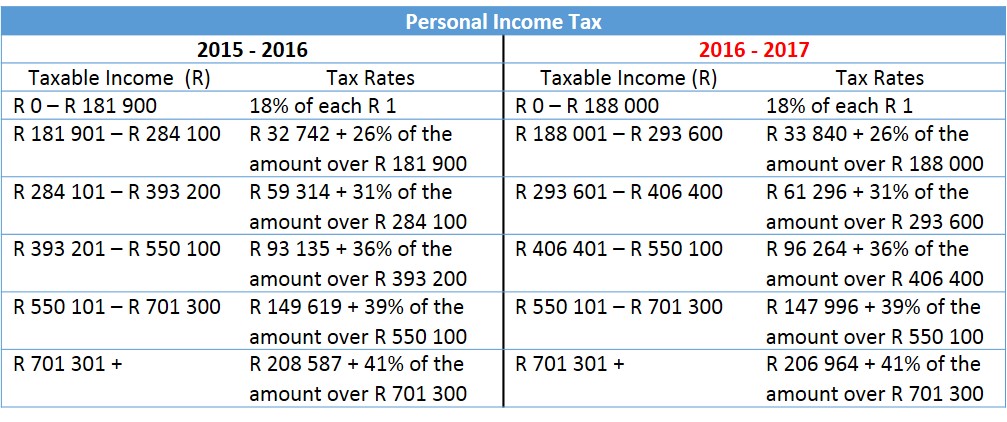

The widely expected increases in Personal Income Tax and Value Added Tax were left unchanged. All individuals, irrespective of their taxable income, will pay slightly less income tax than the previous tax year. Value Added Tax (VAT) will remain at 14%. VAT is levied on the supply of goods and services by a vendor making taxable supplies of more than R 1 million.

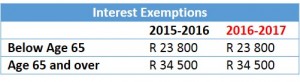

Unfortunately the annual interest exemptions of R 23 800 (younger than 65) and R 34 500 (older than 65) have not been increased. The interest exemption was initially implemented to encourage savings. The government realised that the interest exemption was not being used for the purpose it was intended for, and therefore created the Tax Free Savings Account. They did not remove the interest exemption, but it was not increased either.

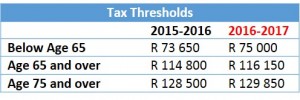

The top two income tax brackets have not been increased to compensate for the effect of inflation and only the primary rebate has been slightly adjusted. The table below illustrates a comparison between the 2016 and 2017 personal income tax:

Personal Income Tax:

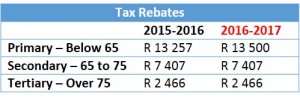

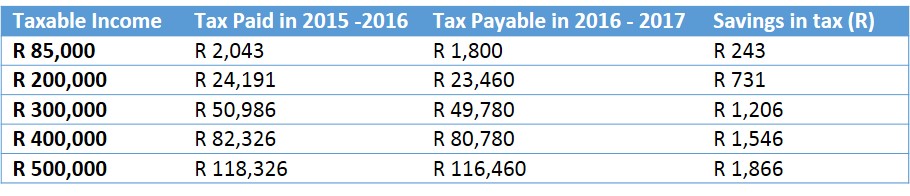

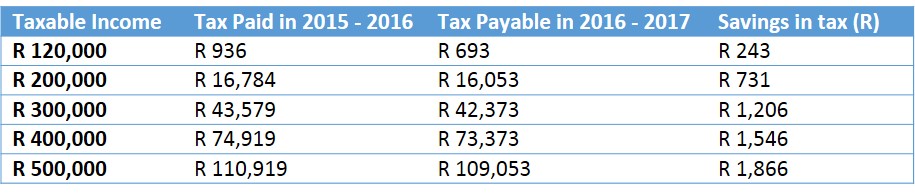

Taxpayers will save the following amounts:

Taxpayers younger than age 65

Taxpayers older than age 65

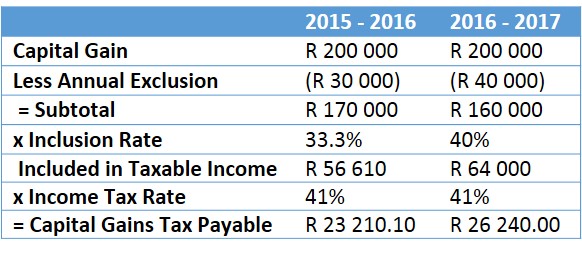

- Capital Gains Tax

Capital Gains Tax is payable when you sell assets such as property or shares. As of 1 March 2016, the following changes will be effective:

- The inclusion rate for individuals will increase from 33.3% to 40% resulting in a maximum effective tax rate of 16.4%.

- Individuals will only pay capital gains tax above the annual exclusion amount of R 40,000 (R 30,000 in previous tax year).

- The inclusion rate for trusts and companies will increase from 66.6% to 80%. This results in an effective tax rate of 22.4% for companies (previously 18.6%) and an effective tax rate of 32.8% for trusts (previously 27.3%).

Let us assume you pay tax at a marginal rate of 41% and made a capital gain of R 200 000 when you sold your asset:

The Capital Gains Tax exclusion at death remains R 300 000.

- Transfer Duty

Transfer duty is payable when you purchase a property. Should you wish to acquire a property above the value of R 10 million, you will pay transfer duty at 13% (previously 11%). Transfer duty payable on property below the value of R 10 million will remain unchanged.

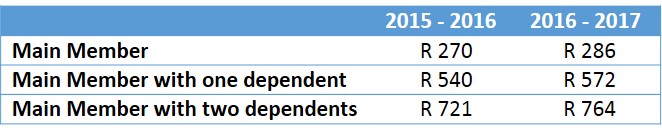

- Medical Scheme Contribution Tax Credits

The medical scheme tax credit increased in line with inflation. Please see the comparison tables below:

- Retirement Reform

At last, the retirement reform will be implemented as of 1 March 2016. The tax deduction in respect of all your retirement contributions are limited to 27.5% of your taxable income or remuneration (whichever is greater), subject to an annual limit of R 350 000. Any amount in access of R 350 000 will rollover to the following year.

The deduction is in respect of contributions made to any retirement vehicle – retirement annuity, pension fund or provident fund. You are allowed to include passive income such as rental or annuity income as part of your remuneration – previously this was not the case – and thus, are encouraged to save more because of the tax benefit you receive.

Should the fund value of your retirement fund be below R 247 500 at retirement, you are able access the full benefit as a cash lump sum. The Retirement Fund Lump Sum Benefits tax tables, however, will remain the same and no inflation adjustments has been made.

Please note that the annuitisation of provident funds will be postponed until 1 March 2018. This means that should you retirement from a provident fund, you are able to access the full value of your provident fund.

- Estate Duty and Donations Tax

No changes have been made to estate duty and donations tax, but Mr Gordhan informed us that there are measures on their way to strengthen estate duty and donations tax as some taxpayers use trusts to avoid paying these taxes.

Some of the proposals mentioned were:

- When a taxpayer transfers assets to a trust through a loan, the value of the assets must be included in the estate of the founder at death.

- When a taxpayer transfers assets to a trust by means of an interest-free loan, it will be seen as a donation. After the exclusion of R 100 000, the taxpayer will be liable for 20% donations tax.

- Further measures to limit the use of discretionary trusts for income-splitting and other tax benefits will also be considered.

- Voluntary Disclosure of Offshore Assets

Taxpayers have been offered a six month grace period, from 1 October 2016 to 1 March 2017, to disclose all the assets held and income received offshore without incurring any penalties.

If you are a South African resident, you may be liable to pay tax on your worldwide income and also pay estate duty, irrespective of where in the world your assets are. It is therefore important that all disclosures are done and to do proper estate planning.

Although the budget offers some tax relief for consumers, the increasing food prices and interest rates clearly indicates that it is not a time to spend unwisely. The fundamentals for future tax increases has been proposed and you need to keep that in mind when planning for your financial future. Let us review your portfolio with you and explore all the possibilities.