It is February 2018, and conversations are starting around the upcoming budget speech and marking the end of another tax year for individuals. This is also the last chance where you can take advantage of the tax deduction received from contributing to your retirement fund for the 2017/2018 tax year.

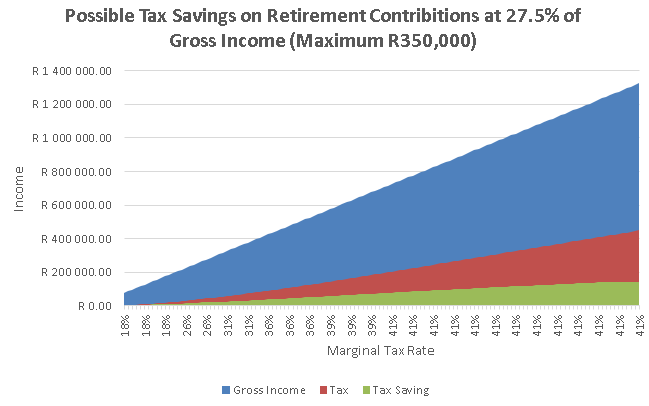

As an individual you are able to contribute up to a maximum 27.5% of your remuneration towards a retirement fund, which includes a pension, provident fund or retirement annuity, to reduce your taxable income. There is a maximum monetary value of R350,000 for contributions to be deductible.

The graph below illustrates the tax savings a person under 65 can expect depending on their income and assuming they are making the maximum tax-deductible contribution.

We are constantly looking for those end of the month specials on the 55-inch TV or shoes. Why is it then so difficult to invest in our retirement at a discount?

Think about it this way. If your marginal tax rate is 30%, you pay 70cents for each R1 you save. What a deal! This is almost equal to a 3-year rolling return. You are thus on a good starting wicked which is better than what the Proteas can say after this weekend.

Did you know that we have an exceptional team who can help our clients reach their financial goals? Get in touch to see how we can help you.