Budgeting is an ongoing process, which needs to adapt to the changes in your life. You get a raise, you lose your job, you have kids, someone near to you passes away, your kids go to University (or worse, Private School!). Your car breaks down, your in-laws move in, your spouse loses their job. Your medical aid goes up, Avo’s cost more, Data prices don’t fall and you find yourself struggling to make ends meet.

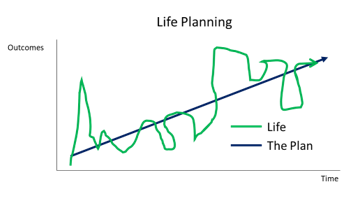

With the endless list of things that can happen in a day, month or year, as planners we know that life is not linear. Life Happens, and that is OK. What is not OK is to be financially out of touch with your monthly income and expenses.

Many people delegate the financial responsibilities of their households to their partners, saying: “she handles the finances, I just spend it” or they would say: “finance isn’t really my thing”. If you trade labour (work) for capital (income) and consume goods and services (expenditure), a budget is a MUST in our view. How else would you know how much you are spending monthly?

A great deal of our time is spent on helping clients successfully transition from their working years to their retired years. Amongst our first questions is usually: “How much do you need in a month”, to which the answer is usually: “I don’t know, how much do you think?”. A budget is a sure-fire way to have a hard and fast Rands and Cents answer to this question, and this question cannot be answered by anyone else than you.

You may be wondering why you need a budget to save money, and the truth is, technically you don’t. If you’re earning so much money and spending so little of it that saving a chunk of cash each month becomes a given, then maybe you’re among the lucky few who don’t need a budget to manage their expenses. However, this does not hold true for most of us. Here are 5 top tips to start on your budgeting journey:

- Check (All) your Statements. Start with your Bank Statements. This should give you a good idea where all your money is going. From there, check all statements for each monthly payment out of your bank account. This could include Phone, Municipality, Internet, Medical Aid, Insurance, Investments, Home Loans, Vehicle Financing, Kids School Account, Clothing Accounts – The list is endless. You would be absolutely astonished to see the kinds of things you are paying for that you didn’t know about!

- Create a Spreadsheet. No need to get fancy. One column for all Incomes, and one column for all expenses. If Income > Expenses, you should save more. If Income < Expenses, you need to cut expenses.

- Classify Expenses. Ensure that you understand the difference between fixed expenses, such as your medical aid premium versus variable expenses such as your monthly groceries bill. Once you have tracked your expenses for three months, you should have a very good idea of what the average expenditure on every line item should be.

- Review. They say feedback is the food of champions – so how do you know if your budget was a “good” budget? We recommend reviewing your budget every month as your income comes in. Review your budget from the previous month to see where you succeeded and where you can improve, and then adjust the numbers for the upcoming month. Budgeting is a process in which you learn a lot about yourself and your financial personality – embrace it for the learning opportunity that it is!

- Adjust. “Everything changes, and nothing stays the same”. You can expect your monthly finances to change at least once a year. If it is not a pay rise, it will be medical aid or any number of things. Make sure you adjust your budget to see whether you need to cut your lifestyle, or go on that holiday!

Remember, budgeting is not intended to be a bad thing. The intention is to empower you with more knowledge to make the best possible decisions. Once you have control over your monthly budget, the investment and savings discussions become about what you know you can afford, and not what you think you should be saving.