As we moved past January, we are starting to see the first specials for the year (after back-to-school of course) – the Valentines Specials.

So instead of spending money on your loved one this year, why not spend it on yourself. This is not buying yourself a new watch or a box of chocolates, but rather investing for your retirement.

As you might know, the government gives you an incentive for investing in a retirement fund. Essentially, you are buying your retirement savings at a discount, hence the “Valentines Special” for retirement savings.

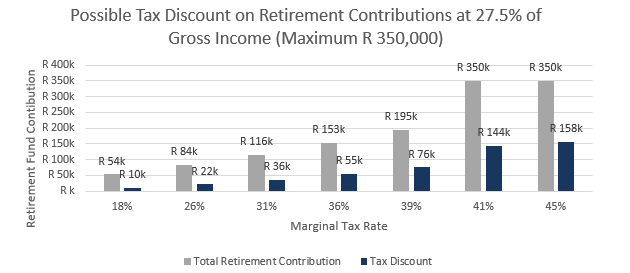

To “qualify” for the discount, you can save up to 27.5% of your annual income, up to a maximum of R 350,000 per annum. For every R1 that you invest, you save according to your marginal tax rate (between 18% and 45%). The graph below shows this in more detail.

It is clear from the graph above, you will purchase your retirement savings at a discounted rate, which means more money in your back pocket. For example, if you fall in the 36% marginal tax rate, you can invest R 153k, while receiving a R 55k discount. You will end up “paying” R 98k for R 153k worth of savings. Bargain!

An important note is that this special does not only run in February or in line with Valentine’s Day but is available all year round.

So why not get in touch to take advantage of this year’s saving. We have until 28 February 2019 to maximise your tax savings.