Two words you will often hear your financial adviser say is “Asset Allocation”. They might say “based on your risk profile, an asset allocation with a focus on growth assets will meet your return target” or “this amount of property is too much, we will need to re-look at your portfolio’s asset allocation”. But what are they talking about?

Let’s break it down. “Asset” refers to the actual assets in your portfolio – this can be equity, property, bonds or cash, whereas “Allocation” refers to the weightings of those assets – for example your portfolio could be comprised of 70% equity and 30% cash. The two words put together gives you “Asset Allocation” – which forms the very basis of the types of risk and returns you can expect from your portfolio.

If we were to rank each asset class by their expected risk and return outcomes over the long-term (7+ years) – we would get the following:

Simply put – over long periods of time higher expected risk can lead to higher potential returns. As shown above equity will provide the highest returns at the highest risk. On the other side of the equation, cash provides the lowest levels of returns and risk. The nice thing about investing though is that we are not restricted to just one asset class – we can combine assets to fit our optimal risk and return budget.

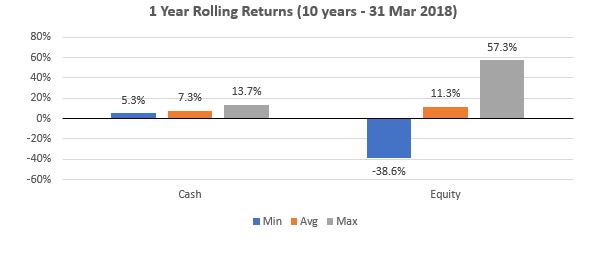

Before we proceed – lets define what risk is. In investments risk can mean many things such as the volatility of returns or the risk of capital loss. We as financial planners, like to define it as the risk of clients not meeting their financial goals – and one of the contributors to it could be being invested in a sub-optimal combination of assets. For example – you have an investment horizon of one year, but you are entirely invested in equity. An obvious and more suitable investment would have been cash. Why do we say that? The graph below explains:

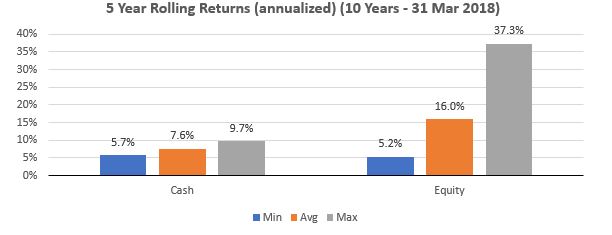

The different outcomes in the returns between the two assets can clearly be seen. Cash over a rolling one-year period – provides the far more safer option. While the average returns aren’t as high as equity, you have the comfort of knowing that your money is stable. On the other hand, equity produced much bigger swings in the return outcomes, with a very high maximum and a very low (in the negatives) minimum. If we were to increase the investment horizon to 5 years – the picture changes quite drastically:

The equity returns look a lot safer – it still provides quite a high maximum however, the minimum is on equal footing compared to cash. Not to mention the average returns are more than double that of cash. We need to however stress that the above is all based on past returns and doesn’t give a clear indication of what future returns might be.

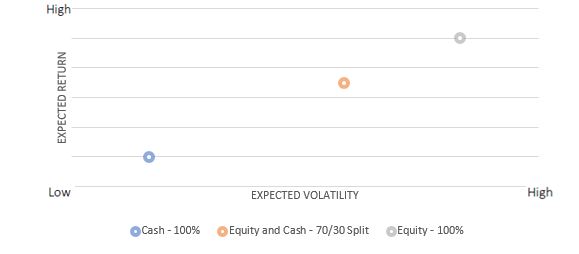

Now that we have a slightly clearer idea of what “risk” is, let’s get back to asset allocation. Suppose for example, you wish to invest some money for the next five years. You want to maximize your returns however, you also want to stick to a moderate level of risk. One way to accomplish this is to combine risky assets with less risky assets. To keep it simple, three portfolios are compared below;

Given your goals, the cash portfolio’s risk and return are too low, the equity portfolio’s return is high, but the risk is also too high. However, by combining a risky asset (equity) with a less risky asset (cash) – you are provided with a portfolio which aligns with your risk and return “budget”. You give up some of the high returns – by reducing equities, however you also reduce the risk – by adding in some cash. You can of course combine many more assets to provide more optimal risk-return outcomes and in effect better diversification benefits.

Therefore, when investing or simply just reviewing your portfolio, it’s always best to understand the purpose of each asset and look at how it functions as a whole – we call this the “portfolio perspective”. Is it there to maximize returns or there to add some protection? How well diversified is the portfolio? What sort of returns can you expect given the asset allocation and is it aligned to your risk profile? These are just some of the questions we can assist you with.