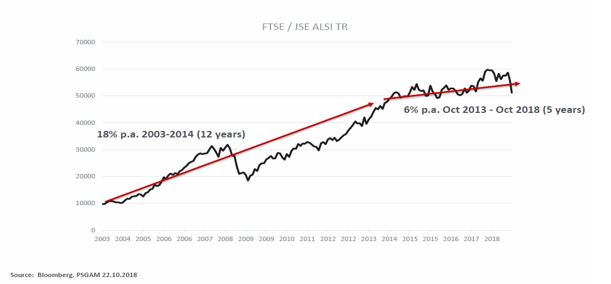

Over the last five years local equity markets have not produced any meaningful real returns. Investors are of course concerned and rightly so. We are often told that our returns should only be judged over the long-term, however five years has gone by and there’s not much to be excited for.

While the above does give insights into the market as a whole, it does not provide much insight in terms of what actual investors have experienced. For example, only if you had started investing in October 2013, would you have achieved these returns.

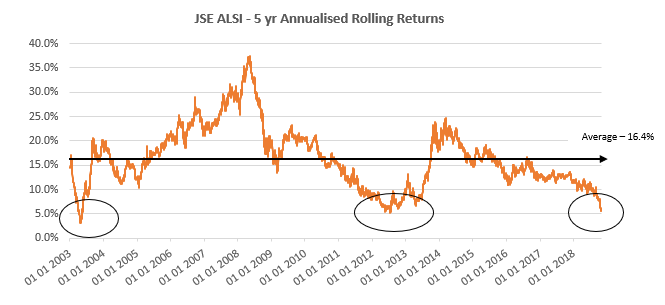

To gain a better perspective into what the end investor would have achieved, we look at the five year rolling returns. This provides us with the annualized 5 year returns over the entire period.

As can be seen, when looking at rolling returns, the picture changes quite drastically. The average rolling 5 year returns over the last 15 years has been 16.4% – much higher than what we are currently experiencing. In fact, we have only been at these sort of levels twice before (2003 and 2012) over the measured period. What is interesting is that after the two previous low points the five year annualized returns were around 37% (this being the highest over the period) and 13% respectively.

We cannot be certain that we will experience these type of returns going forward, it is however interesting to know that when we were previously at these levels, the subsequent returns were a lot more encouraging.

While we understand that it can be tough for investors to see their savings reduce over short periods, we do encourage a long term approach and now could potentially be the most opportune time to invest given the current market environment as the most upside is often achieved when markets are at their lowest.