You have retired and are now drawing an income from your investments. The question is, are you drawing it tax efficiently or is your hard-earned retirement capital being paid to SARS?

In a world where you have a Living Annuity and discretionary capital (let us assume an investment plan), you can receive the same amount of income whilst saving on tax. Both these products have different tax rules, which if structured correctly, can be minimized. We look at the differences below:

Living Annuity

Any income that you receive from a living annuity is income in your hands and taxed according to the Pay As You Earn (PAYE) income tax table.

On your death, a living annuity falls outside of your estate if a beneficiary is nominated and does not attract executor fees (maximum of 3.50% exclusive of VAT) or estate duty (20%) if applicable. This means that by having more capital outside of your estate, you are also saving on taxes.

Investment Plan

Income drawdowns are tax-free. However, one should consider Capital Gains Tax, which is essentially a tax on profits. This is triggered on the disposal of an asset, such as the withdrawals for income. Natural persons qualify for an annual exemption of R 40,000 on the capital gain (profit) within the investment portfolio. Should the capital gain exceed your annual exemption, or if it is already utilized, 40% of the capital gain will form part of your taxable income and will be taxed per your marginal tax rate, for the tax year of assessment.

On your death, an investment plan is dealt with in terms of your will. This means that the executor deals with the capital and will be able to charge their fee. It might also attract estate duty charged at 20%.

Due to the tax rules, of each of these products, you can save tax annually and ultimately at your death. Let us look at the example below which explains the tax on the income payments.

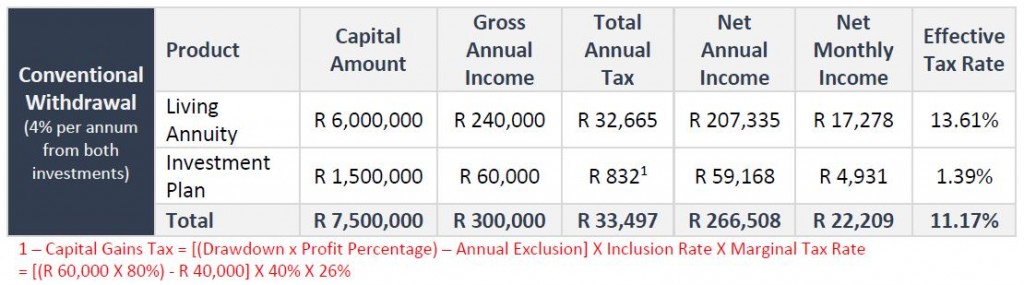

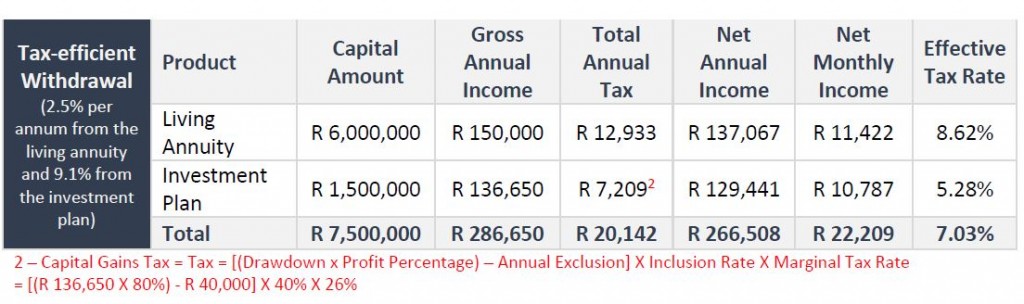

A client with R 6,000,000 in a Living Annuity and R 1,500,000 in an Investment Plan requires income. We have assumed that the Investment Plan has been active for many years and R 1,200,000 is profit. Assuming that the Living Annuity income is the only income that the client receives, her marginal tax rate (as per the PAYE tax table) is 26%. We have used 4% as the annual income drawdown rate with the income being paid monthly.

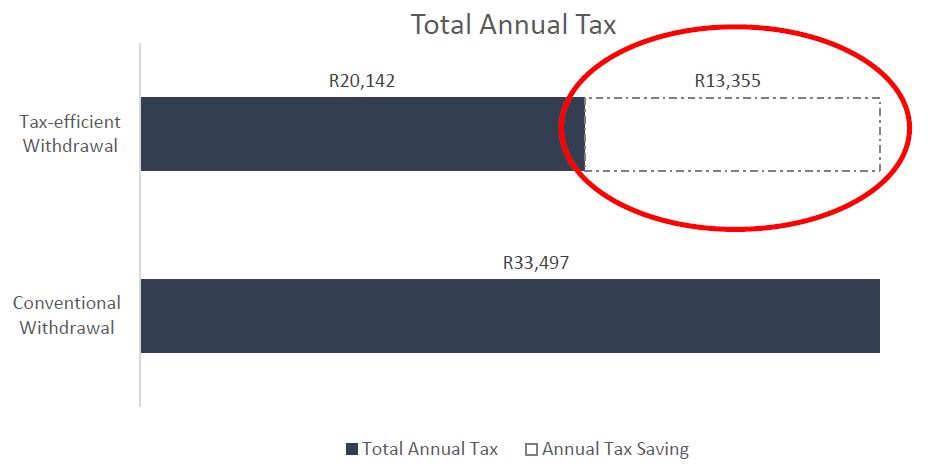

What we can notice from the table above is that by adjusting the amounts to be withdrawn from several types of investments, one can have the same net monthly income whilst saving on tax. You are also reducing the withdrawal rate on the investments increasing its longevity. The graph below reflects the annual tax saving.

What we can notice from the table above is that by adjusting the amounts to be withdrawn from several types of investments, one can have the same net monthly income whilst saving on tax. You are also reducing the withdrawal rate on the investments increasing its longevity. The graph below reflects the annual tax saving.

As you are withdrawing more from the investment plan, you are saving on tax annually, but effectively reducing the capital in your investment plan year-on-year, while giving the living annuity the best chance possible to grow capital over time. You should increase your withdrawal rate from the living annuity as the capital from your investment plan reduces. As you age, you might be in a bracket where your income tax exemption is more, and thus paying less PAYE tax. By using this plan, you will save on tax, but it is important to review this at least annually.

The question is, are you taking advantage of tax planning during retirement?

Get in touch!