You may have heard that you should contribute towards a Retirement Annuity because of the tax deduction that you enjoy on these contributions. This is great, but, it goes far beyond this.

The government implemented a tax relief on Retirement Annuity contributions to urge households to save more towards their retirement. This boils down to the fact that contributing towards a Retirement Annuity costs less than contributing towards a discretionary investment.

The difference is that you contribute towards a Retirement Annuity with pre-tax money whereas contributions towards a discretionary investment are with after-tax money. Please refer to the tables below which illustrate the differences for individuals contributing towards a Retirement Annuity versus a discretionary investment:

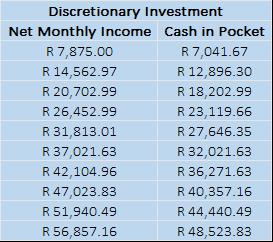

Table 1

Table 1 illustrate individuals with different gross annual salaries and their monthly contribution. The monthly contribution is 10% of their monthly gross salary towards either a Retirement Annuity or a discretionary investment.

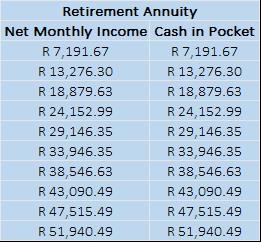

Table 2 Table 3

Table 2 and Table 3 illustrate the net monthly income for the different individuals using the 2017 Year of Assessment tax tables. Furthermore, it illustrates the cash that you have left in your pocket after your monthly contribution towards either a Retirement Annuity or a discretionary investment.

Table 2 is for individuals contributing only towards a discretionary investment with their after-tax money. The cash that you have available in your pocket is your monthly net income less your monthly contribution towards a discretionary investment.

Table 3 is for individuals contributing only towards a Retirement Annuity with their pre-tax money. There is no difference in the monthly net income and cash in pocket as this contribution is made prior paying tax.

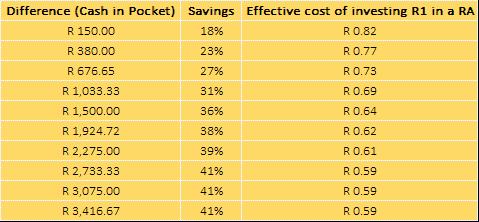

Table 4

Table 4 illustrate that you have more cash left in your pocket when contributing towards a Retirement Annuity instead of a discretionary investment. It is clear that a discretionary investment is immediately at a disadvantage, due to you investing with after-tax money.

When contributing towards a Retirement Annuity you are essentially only paying 82 cents for every R1 that you contribute (18% marginal tax rate) up to a minimum of 59 cents for every R1 that you invest (41% marginal tax rate). This benefit becomes more significant as your marginal tax rate increases.

This means that a discretionary investment has to achieve significant growth to cancel out the tax advantage given to a Retirement Annuity in order for it to keep pace with the Retirement Annuity. It must also be taken into account that income from a Retirement Annuity will be fully taxable. These two aspects will be discussed in part 2 and part 3 of our Retirement Annuities blog.

Some of the other benefits of a Retirement Annuity includes, but is not limited to the following:

- The investment accrual within a Retirement Annuity is tax-free

- Not estate dutiable except when the nominated beneficiary is your estate

- Enjoys protection against creditors

Another important aspect to keep in mind is that when you are investing in a Retirement Annuity the accessibility that you enjoy on your capital is restricted whereas this is not the case with a discretionary investment. We therefore by no means disregard discretionary investments, as it is crucial in anyone’s financial planning. We do, however, want to emphasize the benefit of contributing towards a Retirement Annuity.

If you would like to utilize this benefit to your advantage, please get in contact with us.