The calendar year of 2015 has come and gone, and as we flip to February 2016 on the relatively new desk pad, we look back at an incredibly topsy-turvy month on global markets. Hot Topics included: China, Gold, Oil, Interest Rates, Politics, the Rand. O goodness the RAND.

It is fair to say that this year has not started well for those amongst us prone to anxiety about things we have no control over. The volatile state of the markets has made it incredibly difficult to see the wood for the trees, as every move seems to be the worst ever. Peek at the financial press and you’ll get the feeling that we are in financial Armageddon.

As with all things in life, if you have a properly structured financial strategy, you will survive the tough times and thrive in the good times.

The good news is that this is not the first time in history when investors have faced tough conditions. You have to remember what investing is all about: You are allocating your money to potential growth which, if realized, you share the profits of said growth. The modern investing landscape even gives you the flexibility to set the level of discomfort you are able to bear before the heart-attack sets in.

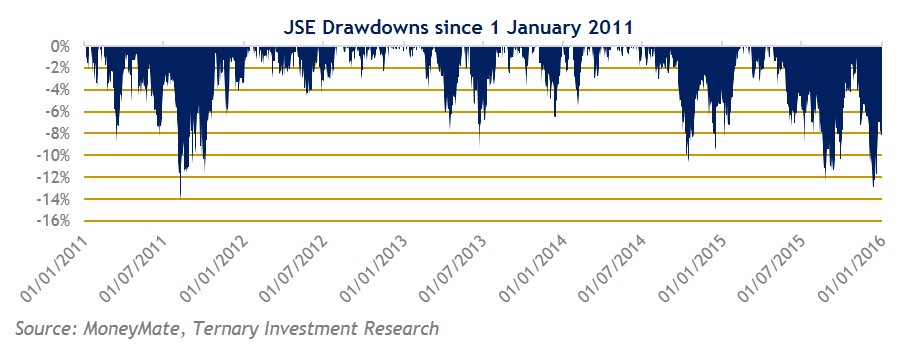

If you still think that investing is a one way ticket to easy money, and that you will never be put in a position where your money could be “down” on paper, consider this graph:

The graph shows the drawdowns (Peak to trough decline) of the JSE All Share Index from 1 Jan 2011 to 1 Jan 2015. For example, in 2011 you could’ve experienced a -14% return on paper had you invested at the worst possible time. By looking at this graph alone, you’d be forgiven for thinking that investing is a rigged game. But remember this, we’re only looking at drawdowns here, which depict the levels short-term discomfort you have had to sit through to enjoy the long term gains.

When sitting patiently through all this discomfort, surely there should be some upside to it? You’re spot on! Had you invested R 100 on 1 Jan 2011 on the JSE All Share index, your value on 1 Jan 2016 would be R 183.92. 5 Years later with 83.92% profit. That’s the upside of discomfort.

Returns don’t come in straight lines and you will never invest for the long term without seeing a short term reduction in your money when markets go ape. This is normal. What we’re going through right now in the world is completely normal. It has happened before, and it will happen again.

During these tough times, you might need someone to hold your hand to navigate your financial ship through turbulent seas, and we are here to help. Why not get in touch with us today?