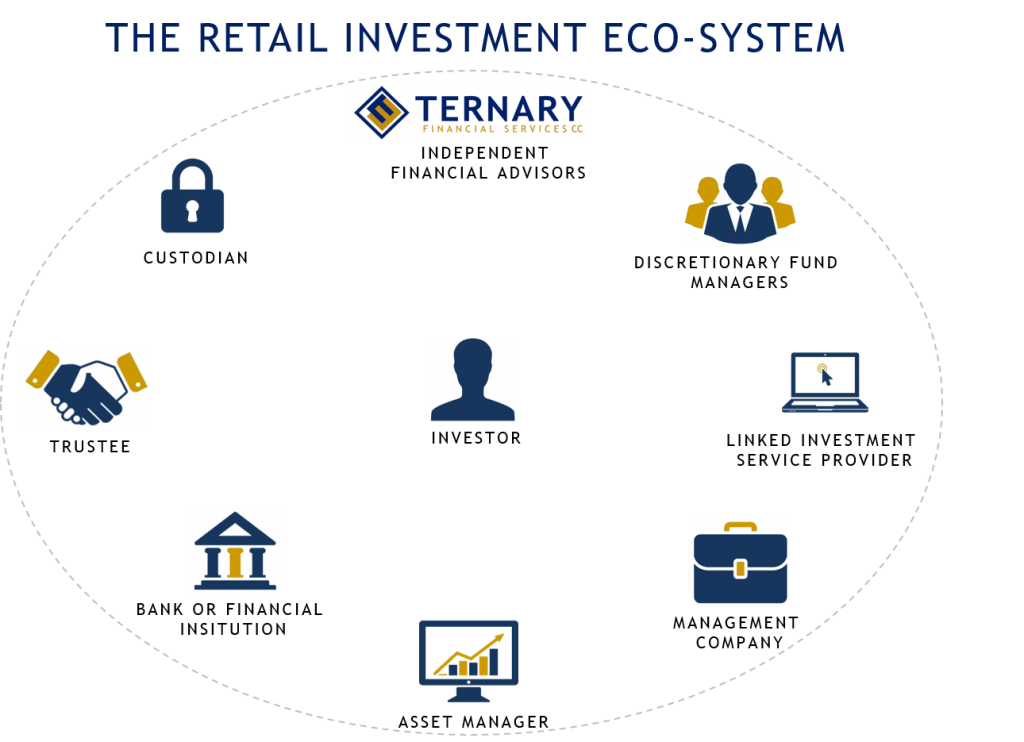

When you invest your hard-earned money, there are several parties that join forces to take you on a journey towards your desired destination.

Some of the parties involved include, but are not limited, to the following:

The initial and most important role-player in this process would be you, the investor. Without investors, there will be no demand and the market will cease to exist.

In our experience you, the investor, would inform us that you wish to invest. Ternary then gives financial advice and guidance based on the purpose of the investment, the time horizon and risk profile, in order to recommend a suitable product and investment portfolio.

There are currently more than 1,400 collective investment schemes or unit trusts in our South African market. This not only makes it highly competitive, but also very challenging to separate the good from the bad and the great from the good. Some financial advisors therefore make use of discretionary fund managers (or multi-managers) to assist them with the asset allocation and fund manager selection of investment portfolios for their clients.

Once you are comfortable with our recommended course of action, we start off by choosing the appropriate Linked Investment Service Provider (LISP). LISP’s can be seen as a supermarket which offer an array of different products. In the financial context, it allows access to a range of various collective investment schemes or unit trusts through products such as Investment Plans, Endowment Plans, Tax-free Savings Plans, Retirement Annuity Funds or Living Annuities.

Central to the success of this process is the Management Company (Manco) which allows investors to pool money together for fund managers to invest. The Manco is the legal owner of the product, for example the Retirement Annuity, and is responsible for compliance (to make sure you are invested according to Regulation 28 of the Pension Funds Act) and the distribution thereof. Legislation requires that a main Trust Deed exist between the asset manager and the Manco. For each additional collective investment scheme or unit trust there must also exist a supplemental deed or fund mandate which sets the parameters for the asset manager to then manage the assets on behalf of the investors in terms of the mandate.

The asset manager invests in securities that will generate returns and these returns are then passed on to the investors. The asset manager is responsible for implementing the fund’s investment strategy in accordance with the fund mandate, makes the investment decisions and decides when to buy or sell stocks, bonds or other securities.

In terms of CISCA, the Collective Investment Schemes Control Act, a manager must open and maintain a separate operational trust account controlled by the Trustee or Custodian for each or all the portfolios/funds administered under its Collective Investment Scheme at a registered bank. This is to protect the investor, should the Manco become insolvent. The Trustee provides fiduciary oversight to ensure that the Manco complies with the Act. The Custodian physically holds the assets and maintains the bank account.

We have a wonderful industry with different role players, all existing to enable individuals to save towards a specific goal. Part of our role is to ensure that this is a pleasant journey for you.