While reading the latest fact sheets of your favourite unit trusts, you may have noticed a section dealing with income distributions. Then you may have thought to yourself “Hey that’s quite nice, but what does it all mean?”

First off, when invested in unit trusts, whether it’s a high equity fund, a low equity fund or some interest yielding income fund, these unit trusts are bound to have some asset class that pays out periodic distributions over the year. These may include dividends from shares, or interest payments from bonds and cash.

So in your capacity as an investor in these unit trusts, you are entitled to a piece of the distribution pie. “Nice, but should I eat it now or save it for later?” is what you may be thinking. Asset Managers will usually give you the option to choose. So whether you are hungry now, or would like to save it for later is ultimately up to you, but let’s have a look at just how much of an influence these slices actually have on your overall portfolio growth.

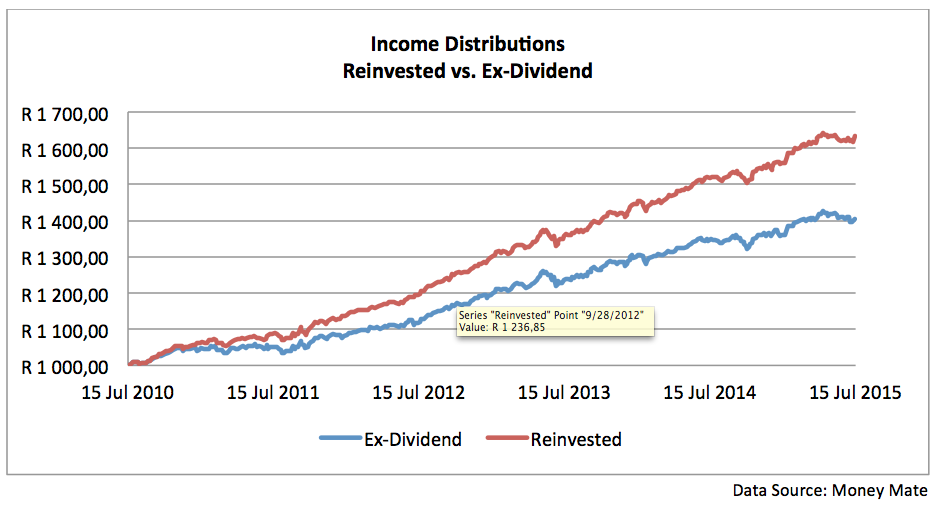

Below is a simple example of how R 1,000 would have grown over five years should you have reinvested your distributions or rather had it paid out to you. The data used assumes you were invested entirely in a portfolio composed of the average Multi-Asset Low Equity fund. These unit trusts are composed of various asset classes, such as equities, bonds and cash, which pay out periodic income distributions.

From the above graph, you can clearly see the benefits of how your money would have grown should you have reinvested your distributions or not. Over the five year period, reinvesting the distributions would have earned you an annualized return of 10.31% vs. only 7.07%. Breaking this down further, the extra growth you would receive from the reinvested distributions over the Ex-dividend amount, which is R 226.58, represents more than 20% of your initial investment.

Thus when saving for the future, income distributions from the unit trusts you may be invested in, can have a considerable effect on the growth of your portfolio.