In part 1 we illustrated the tax savings benefit of contributing towards a Retirement Annuity (RA) as opposed to a Discretionary Investment (DI). The primary difference is that you contribute towards an RA with pre-tax money whereas you contribute towards a DI with after-tax money. Please click here if you would like to read part 1 again.

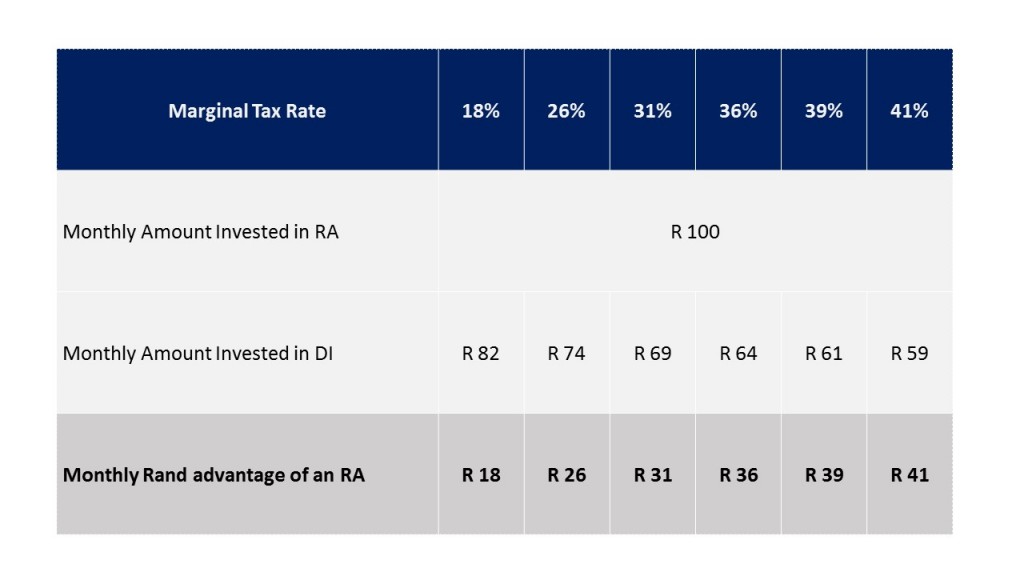

Today, we look at the difference in saved-up money between the two options. Table 1 Shows the actual amounts saved in an RA vs a DI if you make a monthly contribution of R100 per month, with pre-tax money.

Table 1

As we can see, the monthly difference in amounts saved becomes more significant as the marginal tax rate of individuals increase.

So if we pause and think about this for a moment, a DI needs to make up for this difference in monthly amounts invested by performing at a much higher rate to reach the same end-destination. To calculate what the required investment growth for a DI is, we need to make some assumptions:

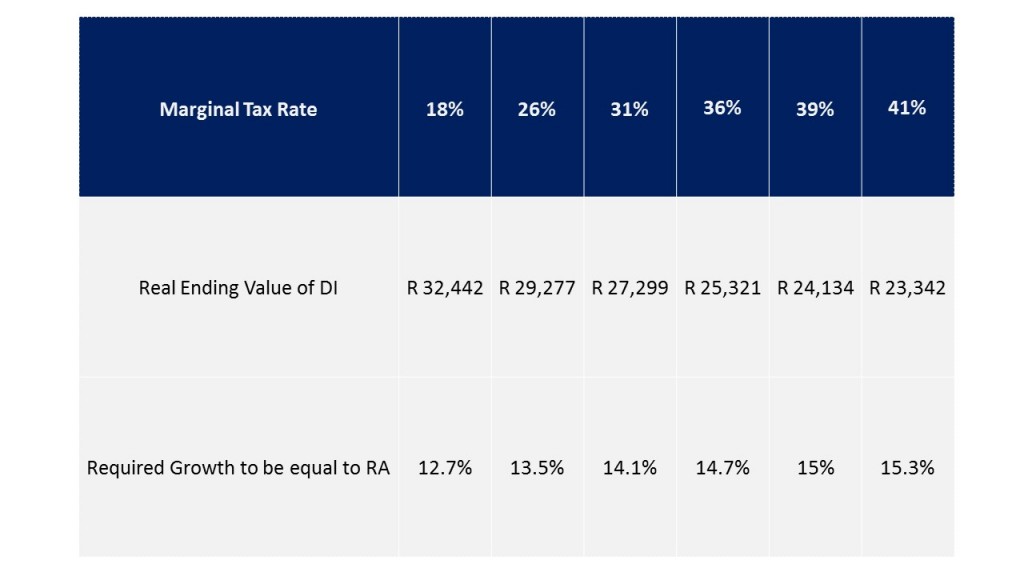

The question we are asking is essentially this: How much does your DI need to grow by to provide a Real Ending Value of R 39,563 after 20 years?

Table 2

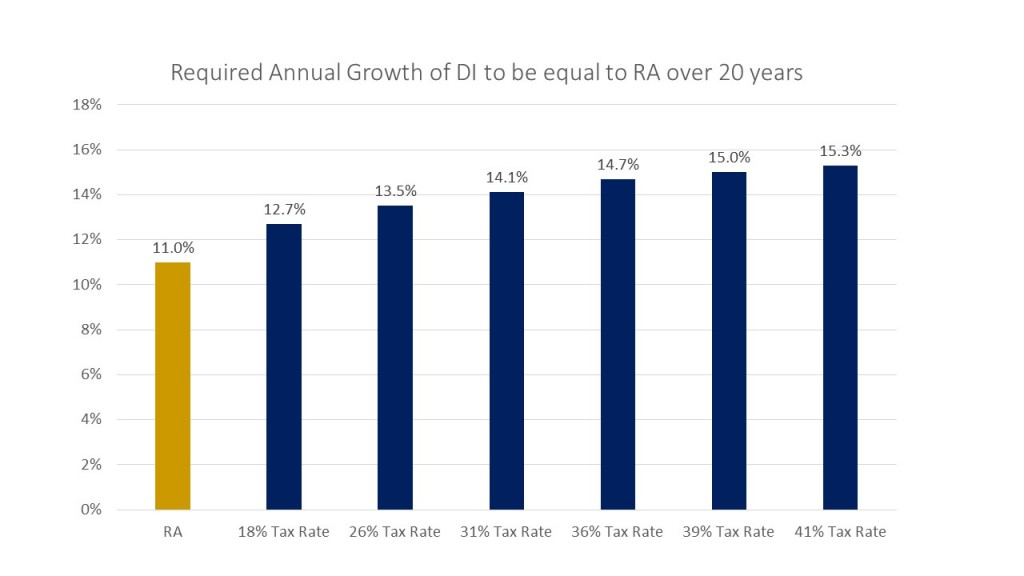

Chart 1

Chart 1 shows us that if you were in a marginal tax rate of 41%, your DI needs to grow by 4.3% more every single year to keep up with an RA. In the current low-growth environment that we find ourselves in, we simply do not see a high probability that you are able to invest for a 15.3% annual return over the next 20 years.

Chart 1 shows us that if you were in a marginal tax rate of 41%, your DI needs to grow by 4.3% more every single year to keep up with an RA. In the current low-growth environment that we find ourselves in, we simply do not see a high probability that you are able to invest for a 15.3% annual return over the next 20 years.

RA’s are subject to regulation 28 of the Pension Funds Act which sets out the maximum exposures that your portfolio may have to various asset classes. These limits are 75% in equities, 25% in property and 25% in foreign assets. This limitation is not applicable for DI’s. Therefore, there may be an argument that you can structure a more aggressive portfolio, for instance 100% in shares, and achieve the more superior investment growth. However, a very important aspect to keep in mind is that the investment accrual within a RA is tax-free whereas this is not the case within a DI.

In part 3 of our series, we will take a closer look on the differences in income from these two products. We want to emphasize that the purpose of this article is not to disregard DI’s, but rather emphasize the benefit of contributing towards a RA.

Please get in contact with us if you are interested in benefiting from a RA investment.