In part 1 we demonstrated the tax savings benefit of contributing towards a Retirement Annuity as opposed to a Discretionary Investment. In part 2, we illustrated the required investment growth required for a Discretionary Investment to keep track with a similar investment in a Retirement Annuity.

Today, in our concluding part, we will compare the differences in income from these two products when you retire. For purposes of this article, we assumed that the full value of the Retirement Annuity at retirement will be utilized to purchase a Living Annuity.

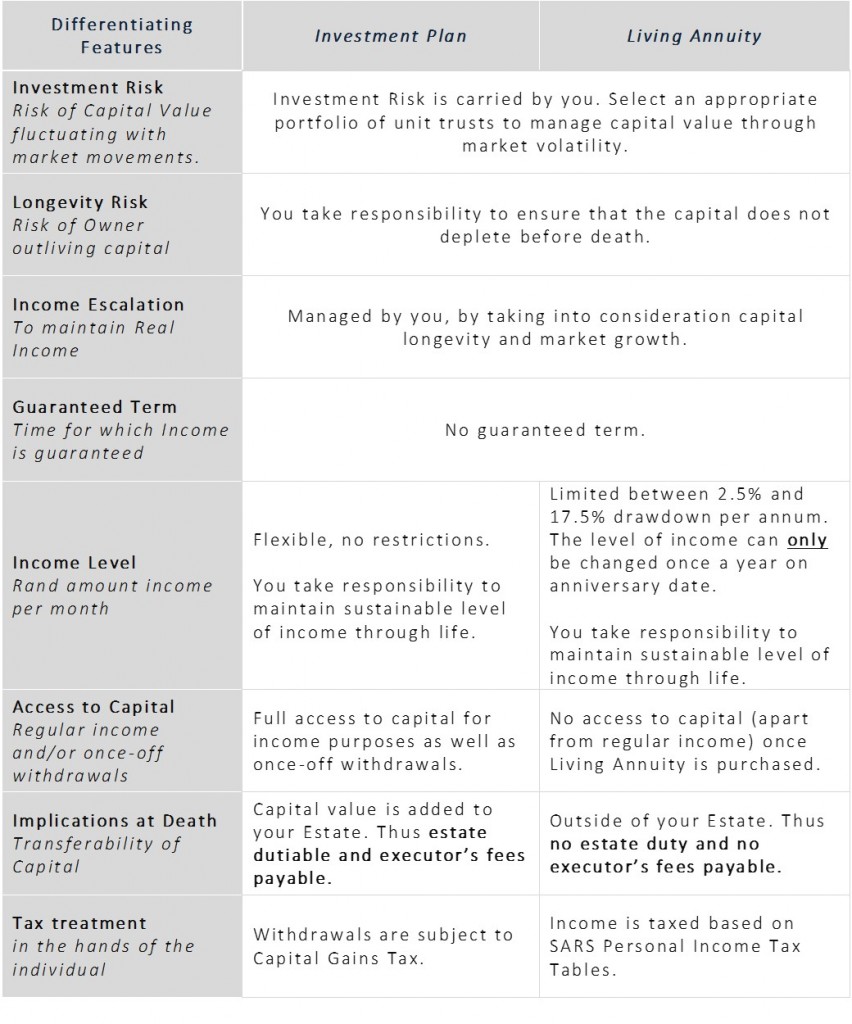

The table below compares the differences in income from these two products:

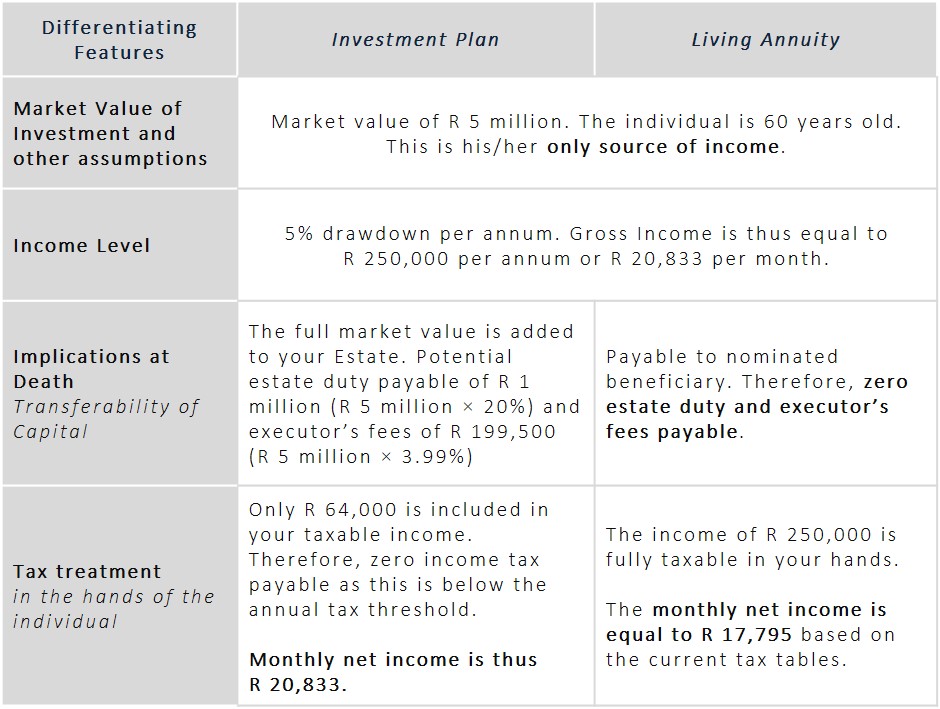

Barring accessibility and flexibility, the most significant difference between these two products for income purposes is the tax treatment. Let us illustrate the tax differences by using a practical example:

Looking at the above-mentioned example, it is quite clear that there is a trade-off between income tax and estate duty for these two products. We do want to emphasize that your choices at retirement and long before then, with your planning, are by no means straightforward. Our role as your financial adviser is to make your journey comprehensible and distinctly suited to you.

Talk to us!